Implement robust systems for tracking time, expenses, and profitability by project

Industries

Business Consultants

Industries We Serve

Business Consultants

Consult the Experts: Financial Excellence for Business Consultants

Are you so busy advising clients that your own finances are neglected? Struggling with project-based accounting and revenue recognition? Finding it challenging to manage cash flow with fluctuating project cycles?

At Proactive Business Services, we provide specialized financial solutions for business consultants and service providers, helping you practice what you preach in financial management while navigating the unique challenges of the consulting industry.

Why Choose us for Your Consulting Business?

Industry-Specific Knowledge

We understand the unique financial challenges of consulting firms, from project-based accounting to variable revenue streams.

Scalability Focus

Our solutions are designed to support your growth, whether you're a solo consultant or a large firm.

Compliance Mastery

Stay ahead of regulatory requirements and tax obligations specific to consulting services.

Technology Integration

Leverage cutting-edge financial tools and project management software to streamline your operations.

Benchmark Analysis

Benefit from our deep understanding of consulting industry benchmarks and key performance indicators.

Strategies for Consultants and Service Providers

Project-Based Accounting

Revenue Recognition

Cash Flow Forecasting and Management

Profitability Analysis

Tax Planning and Compliance

Financial Reporting and Analytics

Business Valuation and Exit Planning

Industry Benchmarks and Key Performance Indicators

Understanding industry benchmarks and KPIs are crucial for success in the consulting sector.

Key Metrics We Monitor:

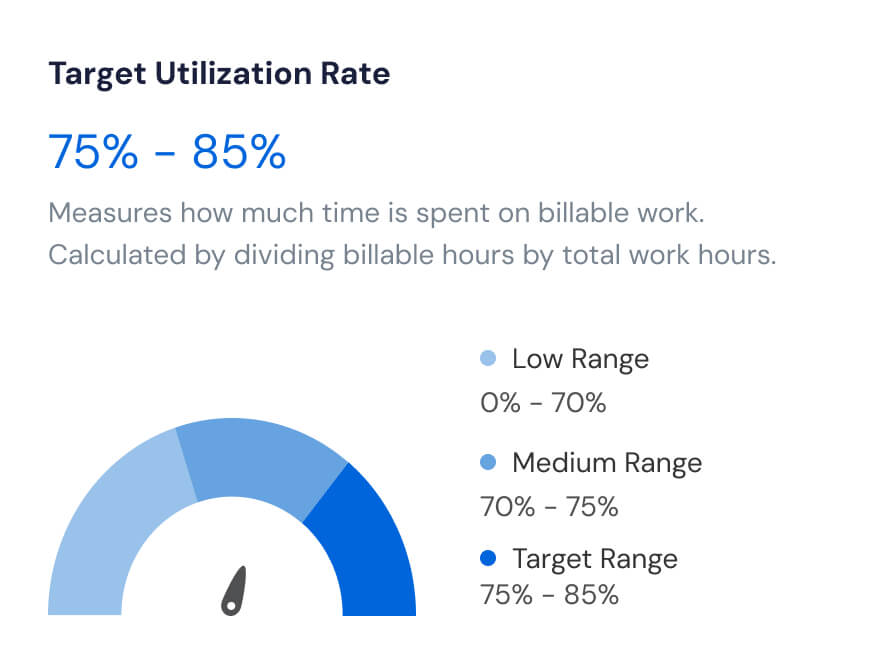

Utilization Rate

Measures how much time is spent on billable work. Calculated by dividing billable hours by total work hours. Aim for 75-85%.

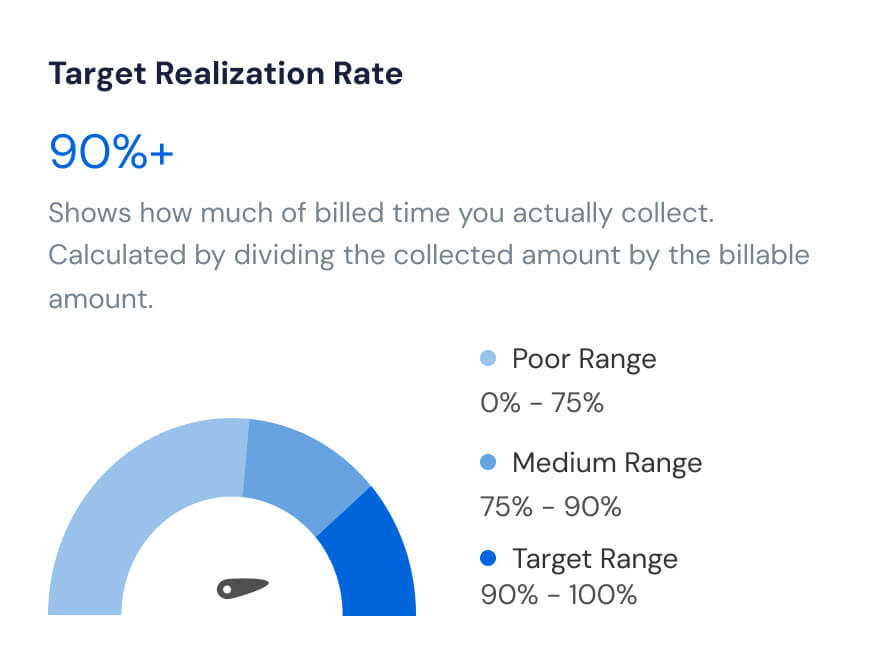

Realization Rate

Shows how much of billed time you actually collect. Calculated by dividing the collected amount by the billable amount. Aim for 90% or higher.

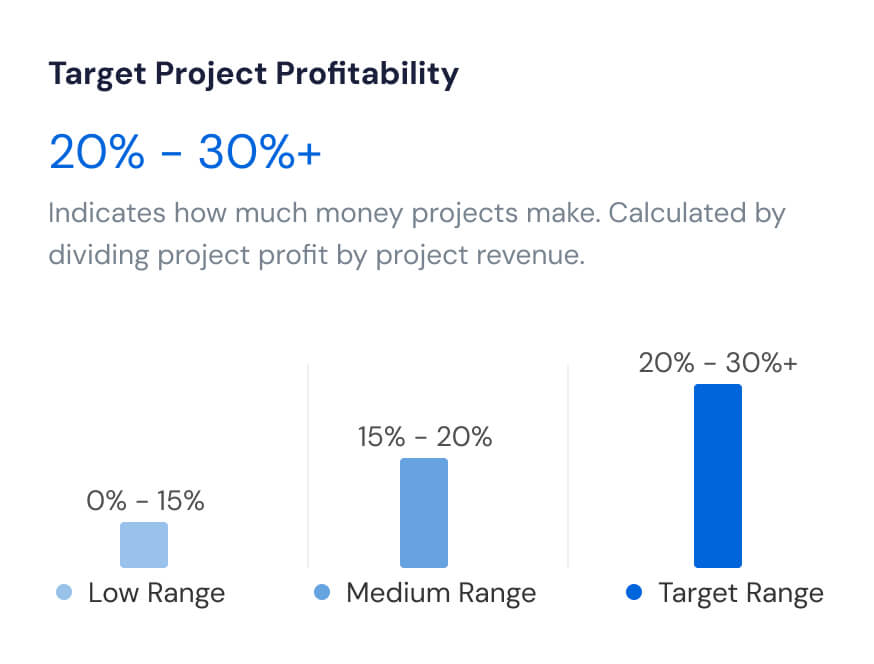

Project Profitability

Indicates how much money projects make. Calculated by dividing project profit by project revenue. Target for 20-30%.

Revenue per Consultant

Reflects how much money each consultant brings in. Calculated by dividing total revenue by the number of consultants. Aim for $200,000-$300,000.

Client Concentration

Indicates if you depend too much on one client. Calculated by dividing the largest client's revenue by total revenue. Aim for no client to be more than 20%.

Understanding these metrics helps businesses to

What Our Clients Say

Strategize Your Path to Financial Success

Book a free consultation to discover how we can optimize your consulting firm's finances and support your business growth.

Schedule Your Free ConsultationCommon Challenges for Business Consultants

Ready to Elevate Your Consulting Firm's Financial Performance?

Contact us now to engage our expertise for your financial success. Let us handle the numbers while you focus on delivering exceptional value to your clients.

Contact UsWhy Business Consultants Trust Proactive Business Services

Consulting Industry Focus

Our team has extensive experience working with consultants across various specialties and firm sizes.

Strategic Partnership

We act as your advisors, providing insights to drive growth and profitability in your consulting practice.

Technology Integration

We help you leverage the latest financial and project management tools to streamline your operations.

Scalable Solutions

Our services grow with you, supporting your journey from solo consultant to thriving firm.

Holistic Approach

We consider all aspects of your consulting business, from project management to long-term value creation.

Proactive Business Services: Your Trusted Advisor for Consulting Finance Excellence

Don't let financial complexities hold your consulting business back. Build a robust financial foundation that supports your expertise and fuels your growth. Optimize your financial performance and focus on what you do best – delivering transformative insights to your clients. Let us be your partner in financial success and business growth.